Last Christmas, I came across a quite bizarre targeting experience.

Just a few days before Christmas, during my final gift hunt, I visited a large department store to buy a present to a member of my family. I am not very good at shopping, yet I had enough luck to find the ideal option that I immediately knew they would love, take it to the cash desk, and leave the store quickly.

Later on the day, I started observing new ads in my social network feeds. The strangest thing about them was that they were promoting the exact same brand that I had chosen for my family member a few hours ago.

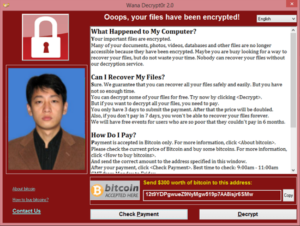

It’s not a secret that we all are being tracked 24/7 by data aggregators, with every single step we make being monitored, recorded, and used later to sell us goods ‘carefully picked’ for us. Everyone of us have come across this annoying situation a thousand times, when our browsing experience all of a sudden became flooded with ads of goods and brands we searched a couple of days before (and some of us may even have ended up with a spoiled surprise if they shared their device with a girlfriend). And with voice assistants coming into play it is well enough just to mention a brand aloud while hanging around your phone to be caught.

But in this case everything was utterly different.

– It was quite unusual for me to buy a product of this particular kind and brand. To be exact, I have never bought anything similar in the past.

– It was a purely offline purchase, and a nearly random choice. No preliminary research. No shopping around for different brands. Saw it, liked it, bought it.

– The purchase being made at a large department store made tracking the chosen brand by location next to impossible. The location service on my phone was off anyway.

– Needless to say that my voice assistant was, and always is, off.

After spending quite a bit of time trying to figure out the source for the leak, I can say for sure that the only link between me and the purchase was my debit card that I used to pay for the gift. And this raises two uncomfortable questions: plainly, ‘who?’ and ‘how?’

The transaction involves the shop, which sells me the item, and the bank, which charges my card. These two business operations, per se, are not connected to each other – the shop has no access to my card details, and the bank has no access to the contents of the till receipt. Yet, the data aggregator needs both pieces of information to know about the purchase!

Obviously, the shop leaked my basket. But how did the aggregator manage to set it off against my identity?

There are only two possible mechanisms to do that without violating payment card industry legislation, and, frankly, I don’t know the use of which one is worse to admit.

The first is that the bank communicates all my transactions to the aggregator. This is easy to do technically, and by signing up with your bank you effectively allowed them to treat your account as they want (re-read your current account use policy, if you don’t believe me). It is easy for the aggregator to establish a correspondence between the basket and the card by the amount, time of purchase, and the merchant. An implication from this version is that your income, financial position, and spending habits are known to a much bigger crowd and at much greater level of detail than you supposed they are. And considering the recent leaks from Equifax, that crowd gains a really enormous size.

The second mechanism clears the bank and assumes that the aggregator uses a few pieces of intelligence they hold about us to establish the match. This is much, much harder, but not impossible. With each purchase you make, the shop gets hold of a tiny piece of your card details (as a general rule, the last four digits of the card number – you will often find them printed on your shop receipts). They can send this little piece to the aggregator together with the contents of your basket. The aggregator would then add this piece of evidence to a huge neural network which they use to store all sorts of information about us – our address, recent purchases, spending habits, and shopping routes, which they accumulate over the years. The network would then use all its knowledge about the persons whose card numbers end with the same four digits as provided by the shop, to assign probabilities to assumptions that the purchase in question was made by each particular person from that list. The person with the highest probability, or maybe a few of them, would then be selected as a target for the next campaign from that brand.

In either case, it’s not good. The main issue is that, one way or another, we don’t know the depth of the aggregators’ knowledge about us. And when you don’t know the rules of the game, you start suspecting the worst.

And who knows whether the worst you are suspecting – that is, the worst as you know or assume it – is the worst worst there is.

N. B. If I start seeing ads from that brand in the near future again, I will know for sure it has nothing to do with the bank.

Picture credit: pxhere.com